When the precious metals were smashed out of nowhere and the dollar

started climbing this summer I became very worried. I didn't question

my conviction that commodities are in a bull market, or that precious

metals in particular are undervalued. I felt something sinister was at

work. Neither move was justified on a fundamental level. I assumed that

something very bad was about to happen and the metals needed to be

brought lower in advance of the bad news.

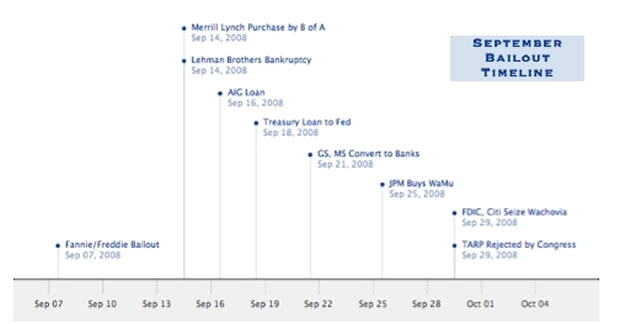

Now we have a glimpse at the ugly consequences foreseen by the

Treasury Department and the Federal Reserve. In early September, Fannie

Mae and Freddie Mac were nationalized with a financial commitment of

USD$200 billion from the taxpayers. Incredibly, the loan limits at the

former GSEs were raised from $417,000 to $729,750 in March when it was

more than obvious these institutions needed to be reined in. Like most

bailouts and bank failures, this one was announced on a weekend to

limit the impact on the stock markets.

As I mentioned in

last month's issue, Treasury Secretary Paulson was under severe

pressure to act, as the Chinese started selling Fannie and Freddie

bonds while threatening further retribution. Common shareholders were

left with nothing, while bondholders like Pimco and Asian central banks

benefited. The small investor was stung again, as taxpayer dollars were

used to bail out foreigners and wealthy Americans in a policy that Jim

Rogers terms “socialism for the rich.”

Unfortunately, $200

billion is just the tip of the iceberg. As the government has assumed

responsibility for Fannie and Freddie's $5.4 trillion in liabilities,

the Congressional Budget Office correctly states that these

institutions “should be directly incorporated into the federal budget.”

The Bush Administration has strongly opposed this move.

Many

commentators claim that the former GSE's liabilities are not like usual

government debt, as the mortgages are backed by homes. However,

Catherine Austin Fitts indicates that many of the Fannie, Freddie and

FHA loans are actually fraudulent, as the same property is sold

repeatedly to phantom buyers or the property does not actually exist.

At least $1 trillion of Fannie and Freddie's mortgages are already in

trouble, and the data on mortgage resets indicates the problem will not

end until 2012. This bailout effectively doubled America's publicly

traded debt overnight.

On September 14, the Fannie and

Freddie bombshell was followed by the sale of Merrill Lynch to Bank of

America for $50 billion. Paulson admitted he was involved with the

Merrill Lynch purchase at a steep premium to the market price. Bank of

America is hardly a bastion of stability however, as over half its

builders loans “are considered troubled.” The institution is a leading

issuer of consumer credit cards, and with the U.S. in a recession, much

of this debt will default. Bank of America already bought subprime

lender Countrywide earlier this year in a curious deal where the firm

refused to take on many of Countrywide's liabilities.

On the

same day, the 158-year-old Lehman Brothers declared bankruptcy. After

guaranteeing JPMorgan Chase's purchase of Bear Stearns in March and

taking over the mortgage giants, the U.S. Government sternly insisted

that Lehman should be allowed to fail. Not only did this bankruptcy

spook the markets and cast doubt on the solvency of other investment

banks like Goldman Sachs, but it opened up the Pandora's Box of

counterparty risk. Holders of swaps and other derivatives who had won

bets with Lehman could no longer collect, and these contracts reverted

to their intrinsic value - zero. Investors in Lehman's stocks and bonds

were wiped out as well, and institutions had new losses on their

balance sheets that needed to be written off. Highly leveraged banks

were unable to meet their derivative obligations, so they became

insolvent. Fearing contagion, financial institutions sharply raised

Libor rates and other measures of interbank lending as they lost faith

in their peers' ability to repay loans, and credit began to freeze up.

After

viewing the debacle caused by Lehman's failure, Paulson and Bernanke

decided it was too risky to let another derivatives-laden firm go

under. This time it wasn't even a bank they felt compelled to bail out.

AIG was rescued due to its large size and involvement in all kinds of

international markets, with the bulk of its business in reinsurance

(insuring other insurers). Not surprisingly, the $85 billion loan to

AIG prevented a $20 billion loss to Paulson's old firm, Goldman Sachs.

AIG's

involvement in derivatives is consistent with their history of

questionable behavior. The giant insurer had a pre- eminent role in

precious metals trading, and was suspected to be one of the large

silver shorts before its abrupt departure from the market in 2004. In

2005, then-CEO Maurice Greenberg was forced to resign over an

accounting scandal that involved $1.7 billion in fraud. Curiously, no

criminal charges were filed unlike a similar situation at Enron.

AIG

was just one of many bailouts as this month just kept getting worse. A

few days later, three money market funds administered by Reserve

Management Corporation “broke the buck” due to investments in Lehman.

Although money market funds had a reputation as an extremely safe

investment, clients lost part of their principal and were unable to

redeem their funds for a week. Not reassured by government officials or

fund managers, consumers began fleeing the $3.4 trillion market. To

prevent a full-blown panic, the U.S. Treasury decided to insure the

funds for up to $50 billion for current investors.

On

September 18, the Treasury announced it would issue $100 billion in new

debt to replenish the Federal Reserve's balance sheet. The Fed needed

the boost after “Helicopter Ben” dumped a huge load of dollars into the

economy through unconventional means. In retrospect, this must have

been preparation for the expansion of credit through the discount

window. Borrowing by primary dealers and commercial banks exploded last

week, doubling to over $262 billion.

I doubt it's a

coincidence that on September 21, the Federal Reserve allowed Goldman

Sachs and Morgan Stanley to convert to bank holding companies, easing

the standards for collateral pledged in return for loans. Not only will

these converted firms be able increase their liquidity on very

favorable terms, they can court federally insured customer deposits for

the first time.

In August, I published a chart of Washington

Mutual, and predicted its imminent failure. WaMu was seized by the FDIC

on September 25, and has filed for bankruptcy. The majority of branches

and assets were sold to JPMorgan Chase. However, the bank refused to

acquire WaMu's liabilities, leaving shareholders and bondholders out in

the cold. The new CEO of WaMu, Alan Fishman received $20 million for

less than three weeks of work. It's unknown what the burden on the U.S.

tax base will be.

The bailouts continued this week, as the

U.S. Senate passed a bill on September 28 awarding $25 billion in

subsidized loans to automakers. The car companies will not have to make

payments for five years. That was a modest giveaway compared to the

FDIC's involvement in the Wachovia sale the following day. Citigroup

took over the struggling Wachovia Bank, agreeing to absorb the first

$42 billion in losses with the FDIC assuming the remainder. Fed chief

Bernanke approved the FDIC's involvement, stating it will help

stabilize the markets. In exchange for $12 billion in preferred shares

and warrants in Citigroup, the FDIC became liable for losses up to $270

billion. As I predicted, the FDIC is running short of funds to repay

depositors in failing banks and may need to borrow tax dollars from the

Treasury.

Not surprisingly, the ever larger bailout packages

proposed by the Bush Administration have created heavy backlash from

the American public. While many citizens are losing their jobs and

their homes, financial executives like John Thain receive multi-million

dollar paydays as a reward for their spectacular failures. Although

most media outlets neglected to report it, hundreds of protestors on

Wall Street demonstrated against the bailouts last week, many holding

signs reading “Jump!”

Despite

fear-mongering by President Bush, the last scheme proposed was too much

for Americans to bear. In the Troubled Asset Relief Program bill

(TARP), Paulson effectively asked to be the financial dictator of the

U.S. The Treasury Secretary insisted that he needed $700 billion to buy

whatever toxic assets he chose, without oversight or input from any

court or administrative agency. This bill was rejected by the House of

Representatives this week under heavy pressure from angry constituents.

However, a revamped bill with added sweeteners looks likely to pass

soon.

Since

Congress was not very cooperative, the Federal Reserve added $330

billion in bank swaps with foreign central banks to boost the

availability of dollars worldwide. Bernanke also expanded the Term

Auction Facility (TAF) by $300 billion for a new total of $450 billion.

The TAF has even looser standards than the discount window which was

was supposed to be the lender of last resort, but the TAF charges a

premium to market rates. The Fed had already eased its lax standards on

September 14, accepting a wider range of collateral for loans. So even

as the Congress was rejecting a $700 billion bailout, the Fed was

quietly conducting its own $630 billion bailout.

After the

House rejected the TARP proposal on September 29, Paulson, Bernanke,

and the rest of the Plunge Protection Team had to make their

predictions of dire consequences look correct. They allowed the Dow to

crash 777 points - a new record - while gold soared. However, the PPT

is afraid of causing too much panic among the public, so they

orchestrated a rally the following day. The dollar surged 1.58, and the

precious metals were stomped to force investors out of hard assets into

Treasuries and other paper.

This essay was one of the most

difficult I have ever written as the situation was so dynamic. It

seemed that no sooner did I explain a Bernanke statement or a Paulson

tactic than my writing became out of date, and a fresh crisis would

sweep the old one off the front pages. I believe that the speed of the

bailouts indicates desperation in Washington. The Bush Administration

is no longer able to plan far ahead, but must react to swiftly changing

market conditions.

Despite Bernanke's assurances to the

contrary, these bailouts mean tremendous inflation of the money supply.

The U.S. can no longer avoid hyperinflation - it is here. The effects

can hardly be overstated when the reserve currency of the world is

debased so rapidly. Empires disintegrate and social upheaval occurs.

Dollar depreciation is not apparent to the masses yet, but once the

realization occurs, the social effect will be explosive. I believe this

is why a U.S. Army brigade from the 3rd Infantry Division has been

given orders to patrol America “to help with civil unrest and crowd

control.

The dollar is doomed but most people don't know it

yet. I recently spoke with a friend who was born in Mexico, and he

agreed that the American public cannot imagine their currency failing.

While U.S. citizens think that a currency crisis is the end of the

world, Mexicans have experienced this multiple times. The central bank

lops a few zeros off the currency and it's given a new name. The smart

people have moved their wealth into a different form long before that

happens. Even if Jim Sinclair is correct and the U.S. Dollar is rescued

by linking it to gold in a Federal Reserve Gold Certificate Total Value

Ratio, it will not be the same dollar we know today.

Americans

will soon learn to change their mindset from focusing on their return

on capital, to worrying about conserving the capital they have left. We

have seen the beginning of this paradigm shift in the run on banks, and

the flight to Treasury instruments. Investors need to insure their

portfolio is full of precious metals and other commodity-related

assets. While hard assets have suffered lately, that will inevitably

change as mistrust spreads throughout the financial system. If you

position yourself appropriately, your wealth can not only survive the

currency crisis but also secure your future.

by Jennifer Barry

Global Asset Strategist

http://www.globalassetstrategist.com

Copyright 2008 Jennifer Barry

Hello,

I'm Jennifer Barry and I want to help you not only preserve your

wealth, but add to your nest egg. How can I do this? I investigate the

financial universe for undervalued assets you can invest in. Then I

write about them in my monthly newsletter, Global Asset Strategist.

|