|

|

楼主 |

发表于 2009-12-25 10:03 PM

|

显示全部楼层

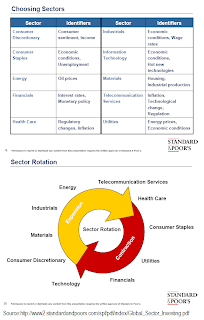

However, it is kind of conflict with this picture

Sorry, I could not find the big one some ...

ranchgirl 发表于 2009-12-25 21:50

This picture is too general, there a lot of this kind investment clock around.

In recovery phase,

Tech sector average return is 3.3%

Utility sector average return is -3.1% |

|