|

|

本帖最后由 bokchoy888 于 2018-1-28 12:46 AM 编辑

https://seekingalpha.com/article ... -trigger-sell?ifp=0

Summary

Current share price assumes perfect execution which is unrealistic.

Next potential trigger for sell-off could be legislature delays.

Possibility of delay driven by opposition in the senate, push back from provincial and municipal governments and police not ready.

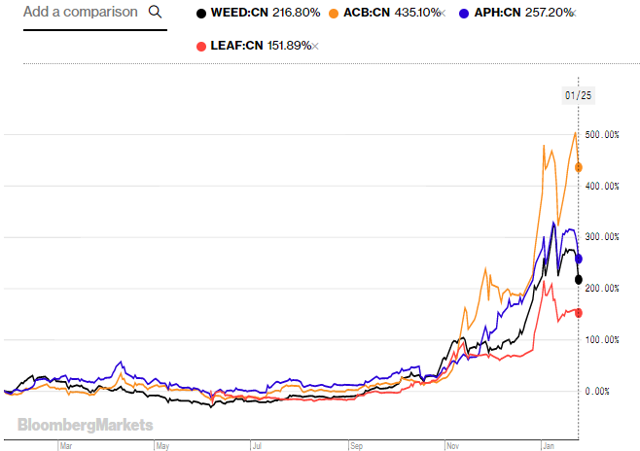

The Canadian pot stocks have been on fire lately with most companies saw their share price surging in the last year. Canopy (OTCPK:TWMJF) share price has appreciated over 200% in the last 12 months. Other large companies have also gained 150% to >400% over the same period. It seems like nothing can stop the Canadian pot stocks. But is that really true? We think there is one major risk that could potentially trigger a major sell-off for Canopy and more broadly the pot sector.

How High Can They Go?

Plenty of news and media pundits have tried to make sense of the rally in pot stocks lately. The share prices for pot stocks has deviated from reality and even the most optimistic projections can hardly justify the market capitalization in the sector right now. As we wrote in our Part III of the Cannabis Guide Series:

The StatCan report estimated 2015 cannabis consumption of 700 tonnes and cannabis sales of $5 billion to $6 billion in 2015 based on $7-8 price per gram.

The current market capitalization of Aurora and Canopy has both surpassed the estimated total cannabis market in Canada. Bloomberg reported that Canada has at least 84 companies tied to marijuana that trade on its stock exchanges, with a combined market valuation of about C$36.9 billion. What this means is that the sector has assumed flawless execution post legalization and has left little room for error. Future upside is also muted given the already rich valuation.

Canopy's Largest Equity Offering

In January 2018 Canopy issued C$201 million of bought-deal treasury equity offering, passing Aurora's previously announced C$200 million bought-deal equity raise as the largest equity issuance in the cannabis sector.

We think the slew of equity offerings recently echo our concerns around the current valuations in the sector. Companies were caught by surprise as share prices rallied late 2017 and into 2018. Urged by investment bankers most pot companies have decided to take advantage of the overheated market and issue equity. Canopy's equity offering seems to us just an opportunistic raise to take advantage of the current share price. Management gave generous discounts to underwriters and did not really need the money. We take caution in the recent equity raises across the cannabis sector as a sign that the management is trying to sell shares at current levels without demonstrating a real need for the raised capital. Canopy, just like other pot producers, have been trading at massive multiple relative to its expected revenue and profits. As we have reiterated in our first article on Canopy that Canopy' share price implies an aggressive revenue ramp-up and market share assumption that is not likely to be guaranteed day one upon legalization. We believe the share price is currently driven by heightened investor interest and lack of market data to anchor the valuation. Investors are not valuing the companies based on cash flow or profitability, but rather news-driven and short-term trading.

This Could Trigger a Sell-Off

We think the biggest risk for Canopy that could trigger a massive sell-off of the stock is a potential delay in full legalization. If you think that the proposed legalization will roll out on July 1 as expected, well, think again. We believe there are three factors that contribute to the risk of a delay in legalization.

Senate Opposition

In Canada, Conservative senators are threatening to delay passing the two bills that would legalize cannabis consumption and toughen rules against abuse. Unless these senators yield, the bills are unlikely to become law in time for the Canada Day deadline. The cannabis bills (Bill C-45 and Bill C-46) have been passed in the House of Commons in November 2017. However, the bills have now entered the senate which has been described by many analysts as "unpredictable". The Conservative have proposed amendments that would delay the target date to later than July 1, 2018. Globe and Mail reported that Conservative Senator Claude Carignan, the lead opposition critic on the legislation, when asked in an interview how long he thought it would take the Senate to pass the bills said "I think we have to do our job properly, and that means months." Another Conservative MP Jacques Gourde issued a call to Senators to block the bill’s passage to prevent an “entire generation” from being “left in shambles by this Liberal recklessness.”

We believe the current political gridlock represents a potential risk to the proposed agenda and could potentially result in delay of full legalization post the July 1 date.

Police Ask for Postponement

Besides senators, police organizations have been asking federal government to postpone the legal date for pot, saying there's zero change they will be ready! Star reported that officials from the Canadian Association of Chiefs of Police, Ontario Provincial Police and the Saskatoon Police Service are among dozens of witnesses testifying to the House of Commons health committee this week as it studies the government’s bill to legalize marijuana. The representatives said that they need more time to train officers and hire more police officers to conduct roadside drug impaired driving testing.

The police warned that if the government doesn’t postpone the start date there will be a window of six months to a year when police aren’t fully ready, which will allow organized crime to flourish.

Source: Toronto Star

Provincial Readiness

Provinces across Canada have been struggling to keep up with the proposed July 1 date for legalization. There are many open questions that need to be answered and rules put into place before provinces can open business. Who can grow it? How will it be retailed and marketed? What level of taxation will be applied? How will new laws associated with a million and one different aspects of legalization be enforced? Who covers those costs? What happens when someone's dog dies after eating a neighbor's marijuana plant?

Provinces are also facing a critical task to deal with the long-existing illegal market. "There are some existing producers who are best described as being in a grey market," Mr. Farnworth, who is overseeing British Columbia's legalization efforts, said. "They are not involved with organized crime but they do underpin a number of local economies. If the goal is to get rid of the illegal black market, then it makes sense to find a way to bring those people into legitimacy rather than outlaw their involvement." Otherwise, they are likely to continue serving their clients at prices that are lower than what are being charged through the new, legalized regulatory system."

Provinces need to draft new laws, amend existing laws, set up law enforcement. Coordination between provinces and city would also become an issue when it comes to sharing enforcement duties and how sales are organized in each of the municipalities.

Impact on Canopy Share Price

What would be the impact of a potential delay up to months for the emerging cannabis industry in Canada? We think the impact will likely be large due to two reasons:

The revenue and profitability of Canopy have been pushed deep into 2019 and even 2020. Canopy's market capitalization already implies aggressive assumptions on even the remote 2019 and 2020 "estimates". Canopy won't be able to achieve "run-rate" until a couple years into legalization due to the amount of time it takes to ramp up production and supply. Provinces also need time to set up retail channels. Imagine if legalization is delayed for 6 months, the cash flow would be delayed for 6 months, return on investments would be delayed, the inventory will be held up for 6 months potentially resulting in loss. Canopy has spent millions of capital to ramp up production and prepare for the legalization, any delays could severely disrupt operations and impact signed supply agreements.

Second potential fallout from a delay in legalization is the trigger of massive investor exodus and profit-taking. Cannabis investors have proven to be sensitive to regulatory changes and law announcements. When Jeff Sessions announced the removal of Obama-era Cole Memo, the sector suffered major setbacks but have recovered since. If a delay is announced, the retail investor base will likely see a large outflow that puts downward pressure on Canopy's share price.

Conclusion

Despite the rally in Canopy share price during 2017 we continue to see a major risk from potential legislative delays that could push the legalization date past July 1, 2018. A delay is possible due to the opposition by Conservatives in the senate, lack of readiness at the provincial and municipal levels and more time required for police to gear up for law enforcement. If the legalization deadline is pushed back by a few month we would expect a major sell-off in Canadian cannabis stocks including Canopy as investors flee on the news and nonexistent fundamental valuation. We highlight the risk for Canopy investors and will continue to watch the legislative progress closely. |

|