Summary

- 4x the S&P 500 returns since inception.

- Durably exploits a non-economic affinity for low volatility.

- This has been my #1 favorite stock in the world for almost 5 years.

A recent article asked the following questions,

1. If you could only own one company in your portfolio, which would it be? Why?

2. If you had $25,000 to invest today on one company and you planned to hold it for 10 years or more, which company would you buy? Why?

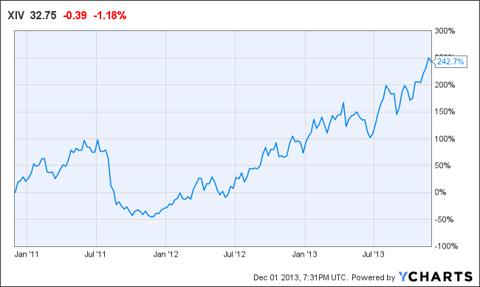

For years, my #1 favorite stock in the world has been the Credit Suisse AG - VelocityShares Daily Inverse VIX Short-Term ETN (NASDAQ:XIV). It has returned almost four times the S&P 500 (NYSEARCA:SPY) total returns.

It is my favorite stock in the world... or my favorite security trading on a stock exchange (since it is not, as many will be quick to point out, a stock. It is an exchange traded note).

Other than expected value, what factors impact your investing decisions?

I always ask that question in search of non-economic counterparties. In late 2012, I found that,

It appears that one common answer since the financial crisis has been a strong, pavlovian dread associated with volatility. I ask this question because we always start by asking what investment counterparties want - or want to avoid - for reasons other than expected value. Who are the non-economic actors and what are they doing? Over the past few years, the answer appears to be "dreading volatility".

Volatility, in and of itself, is neutral to expected value but investors appear to be utterly price-insensitive in attempting to avoid it. With the emergence of faddish financial innovation in the form of various exchange traded notes, it is convenient for investors, including low information retail investors, to express this preference in the capital markets.

Over the past year, this trade has represented an almost perfect transfer from volatility avoiders to expected value seekers. Perhaps the most infamous example is the iPath S&P 500 VIX Short-Term Futures ETN (NYSEARCA:VXX). This security has an expected value of $0.00 over time (and can be directly shorted via either the equity or indirectly via equity derivatives) but serves the purpose of near-term volatility avoiders in the interim. It allows both sets of investors to achieve their stated aim. Over the past year, it is down by over 84%; it will probably achieve similar results in the future.

XIV is close to the perfect security: VXX is fundamentally flawed and XIV is the opposite. In 2013, I wrote that,

This is close to the perfect security: VXX is fundamentally flawed and XIV is the opposite. VelocityShares Inverse Short-Term Volatility ETN (XIV) is the inverse of the VXX ETF. VXX has been one of my favorite short ideas since the fourth quarter of 2011. Ipso facto, XIV is one of my favorite longs. VXX owns forward months one and two volatility futures and rolls some of this exposure each day. The negative roll yield is massive, averaging over 10% per month over the past few years. In short, VXX buys high and sells low as if that is its job… because for all intents and purposes, that is its job. What happens when a portfolio with a 100% roll yield turns over each month? This happens:

The XIV is the opposite - an ETN that is the inverse of the VXX, shorting forward month one and two volatility futures and rolling them forward on a daily basis. XIV buys low (month one) and sells high (month two) when the volatility futures market is in its typical upward sloping curve. Here is what has happened thus far:

Risk is always and everywhere a function of price, not volatility. However, there is a significant part of the market that is arbitrarily adverse to volatility because it is frequently used as a (quite flawed) proxy for risk analysis. Anyone who does not equate volatility with risk, but who recognizes that there are many counterparties that do, can be a service provider for such counterparties by owning XIV. Here is the XIV, versus VXX, with the SPY tossed in for a comparison:

Since then, the XIV has almost doubled the S&P 500 total return, gaining 38% versus 20%. In 2015, I invested my one public model portfolio in XIV; it is up about 69% so far this year. I pitched the investment in an interview in April in which I was asked the following.

EH If you had to pick a stock today and hold it for 20 years, what would it be?

CD: The Daily Inverse VIX Short-Term ETN.

EH: Why?

CD: It is the closest thing the world offers to the perfect security. It is a transfer mechanism between anyone who thinks of risk as volatility and those of us who think of risk as the risk of overpaying. The price-insensitive preference to avoid volatility is a real, durable, expensive preference that is so different than how I think about risk that owning XIV would be a natural thing for me to do for 20 years. It has been a long idea of mine since it was first launched, and I still own it today.

Since then, it is up over 41x the total return from the S&P 500.

Other authors have picked up on this opportunity. In May, Dane Van Domelenmentioned that,

I recently analyzed XIV performance since inception and concluded that it had excellent properties. It boasts a massive compound annual growth rate (39.6% as of May 1, 2015), and seems to have positive alpha, meaning it tends to gain even when the market is flat.

I'm not the only one who is high on XIV. Chris DeMuth Jr., probably the most visible contributor on Seeking Alpha, recently said that if he had to pick one stock to hold for the next 20 years, it would be XIV.

For the past 4 years, 6 months, and 8 days, XIV has been my #1 favorite stock in the world. The opportunity has been due to counterparty selection. There have been enough counterparties that want to avoid volatility regardless of price. The following is how I think about the importance of finding the right counterparties. It is, in fact, the most important part of what I try to do.

I like a good value investor…

I like value investing. Sharing ideas with fellow value investors is fun. The opportunity to learn from and hone ideas with people who share our investment philosophy is something that I will always appreciate. We are on the same side of the table. The world can be a tough place, so it is a comfort to feel less alone sometimes. There is a lot at stake, both personally and professionally. It is just money, but some of the investments that I am responsible for are very impactful to family and philanthropies. Being a good steward is my highest duty.

… but I love a good counterparty

But while I like a good value investor, I love a good counterparty. I can transact business without another soul in the world who is on my side, but I can't get to work until there is someone on the other side. So, what do I look for in a counterparty?

My working assumption is that the average potential counterparty is at least as well informed, at least as smart, and at least as hard working as I am. So that eliminates any opportunity for me to invest based on the theory that I am informed, smart, or diligent. Also, there are trading commissions and taxes. So net of fees and after tax, I assume that the natural state of an investment is to turn a dollar into slightly less than a dollar.

Then, there is the matter of cheating. If only one in a hundred investors are effectively cheating (and assuming that they win every time that they cheat), getting cheated massively impacts the value of an investment dollar. While the average potential counterparty might not be too smart, hard-working, or well informed with either legal or illegal information, the likelihood is much higher when it comes to a counterparty that enthusiastically seeks you out for a transaction.

Without an edge, this is a loser's game - it is "fair" or circular, allowing a participant to churn through a dollar to get a dollar of expected value before paying trading commissions. For me, costs also include fund auditors, fund tax advisors, onshore administrators, lawyers, personal accountants, office support, and office supplies including about five hundred pages of paper per day that I go through just to keep up with SEC filings that I read.

Counterparty Constraints

I am not looking for someone with bad judgment; I am looking for someone with constraints. The most common form of this constraint is someone who is price-insensitive because he is time-sensitive. That happy circumstance fits perfectly with my situation which is the opposite: I am infinitely price-sensitive and infinitely time-insensitive. All I want is to underpay, and I am willing to accommodate any counterparty preferences that allows me to do so. I would not know how to be a value investor without the ability to wait out events.

The institutional reality for many investors in high pressure, hierarchical bureaucracies forces short-term priorities. Earnings are judged by the quarter, and compensation is handed out by the calendar year. When something goes horribly wrong, frequently the most responsible, knowledgeable person is focused on keeping his head down and not getting fired instead of measuring prospective upside, prospective downside, and probability.

Narrow Mandates

Very few asset allocators want to break the rules or to get into trouble. So, if their investment mandate requires them to do something or precludes them from doing something else, they will usually follow those rules regardless of the costs. When an index fund manager owns a security in his index that is the target of a corporate transaction resulting in proceeds that are outside of that index, he will sell those proceeds. He typically sells them on the close (which simplifies accounting and is always a defensible closing mark) regardless of the price. In the recent case of Safeway (NYSE:SWY), sellers sold the Casa Ley rights at a price around half of the offers we received for our rights the next day. These sellers were not ill informed, stupid, or lazy. They were doing their jobs.

During the financial crisis, I was an active buyer of senior secured loans whenever large financial institutions were dumping them on the market in bid-wanted-in-competition/BWIC situations. The sellers were simply trying to recoup their collateral and otherwise cared little for price. They kept marking prices down more and more until they were able to clear out their inventory. That was their job and they did their job. As for other bidders, there were some that had mandates explicitly defined as owning loans that cost over 80% of par. So at $0.60 on the $1, they were out of the bidding but promised to return to the bid side of the market after the prices recovered. We were able to pay $0.60 in a market with an implicit bid at $0.80.

Agency Problems

While I have immense respect for my sources of outside capital, I have a special place near and dear to my heart for my own money. I plan on using it to date my favorite wife, raise my favorite kids, visit my favorite places, and support my favorite philanthropies. My identity as an investor is as a principal, and everything that I have ever done has had a principal orientation. I am my own audience and do only what makes sense to me. When others invest alongside me, their interests coincide. It is that alignment, not my intentions, which one can always rely upon. Investors know that when my ideas have good outcomes, I will be at least as happy and when they have bad outcomes, I will lose at least as much as they will.

But many other investors, including investors with important roles in the industry, have no particular incentive to go to great lengths to ensure that you make money. In one second step mutual conversion that I participated in, I sent in a check for $9 million. The post-conversion shares traded up about 25% within a week, I wrote calls against the entire position, and it was called away. I spoke with a fund manager at a large Boston-based mutual fund company who turned down an allocation in the conversion and then actively built up a large stake in the public secondary market. Why didn't he participate in the conversion at 80% the price? He said that he just preferred to speak with his broker than to deal with mailing in a check (which generates no commissions) even if the price was higher. His decision cost his investors $17 million but saved him having to fill out a form and mail in a check. He didn't doubt that he could have saved the money; he just didn't have a reason to.

Picking My Counterparty: Jim Cramer's Mad Money

Mad Money with Jim Cramer began airing on CNBC in early 2005. Stylistically, it was hysterical, clownish, and somewhat drug-addled; in other words, it offered perfect source of counterparties.

Overnight returns following his stock picks are +3% on average and as much as +7% for smaller capitalization stocks. He moves the market capitalization by over $50 million with his picks. Typically, this show is taped an hour or so before it is aired. Historically, there has not been any price response during taping, but there is an observable spike in both volume and prices during the airing. Such spikes dissipate over time; after a few days the abnormal returns are gone.

There is no evidence of any skill in security selection. In fact, a portfolio of his ideas purchased the day following the recommendations would underperform the market by over 1% a month. His underperformance is statistically significant enough that one could profitably short his long ideas.

While I did not watch the show, in its earlier years I was a regular caller. When placed on hold, callers could hear the only partially muted feed of the show's live taping. I listened for his stock picks, bought them during taping, and sold them during airing or in the following morning.

These were perfectly identifiable counterparties. They were paying for entertainment and getting what they paid for. As for me, I just wanted the money. We each got what we came for.

Picking My Counterparty: High Flying Sheiks

Credit was loose and asset price inflation was everywhere. But what could that be for the bargain hunter? We price-sensitive sleuths search the world for price failures, for counterparties whose time-sensitivity leaves them little room to negotiate effectively on price. Often, these counterparties are in a bad way - pressured, leveraged, failing, and out of control. However, there can also be price-insensitive counterparties at the other extreme - not a care in the world, ultra liquid, prospering, and able to indulge every whim.

So what do they want? Sometimes, they want to be a first mover, to get what they want and to get it now. They want to be first in line. That can cost a lot.

One strategy that can aid in moving towards membership in the ranks of the idle rich is to invest in high-end wait list deposits. These places in line can often be purchased and re-sold for a serious profit to billionaires who can pay practically anything for what they want but were not quick enough to secure an early place in line.

For example, in 2011, the new Gulfstream G650 from General Dynamics (NYSE:GD) went for about $65 million. The manufacturer took an initial order from two hundred customers from various climes (China and the Middle East were well represented). It was the fastest civilian jet in the world, could go 8,000 miles on a tank of jet fuel, and cruised through the dark purple sky at 51,000 feet over undesirable weather and mortals alike. When you step on board, you are not forced to remove your shoes, board by row, or get groped by someone in uniform unless you want to be. If you didn't have one, you didn't have everything.

The catch was that they only delivered fifty per year for the first four years starting in 2012. Starting with the working assumption that everyone wanted one, there were going to be many disappointed billionaires standing around waiting for their plane. So, forget about spending $65 million. Anyways, that would just be the beginning. Hangarage, insurance, jet fuel, landing fees, captain, co-pilot, and flight attendants who let you call them stewardesses cost another $3 to $4 million per year. I had a better idea: just focus on buying a place in line - an initial $500k eventually reaching a full deposit of $3 mil. The chance that you would lose that $3 million or have to cough up another $62 million while standing in line was zero. You never get to the front of the line. Instead, you resell your place in line for twice what you paid and the buyers hardly feel it.

Conclusion

So I am just a fellow looking for a structurally disadvantaged counterparty. If you are one or know of one, please contact me anytime. If you know where to look, suggestions are most welcome in the comment section below. For almost half a decade, my favorite counterparties have been the volatility-avoiders that created the return potential in XIV.

As of today, I have new favorite ideas. If you are interested in finding additional constrained counterparties for mispricing opportunities, please continue the conversation here. However, if you want to pick just one and hold it for twenty years, XIV could still be a great choice. Either the market willcollapse or it won't; if it is still here in twenty years, then XIV price will probably be much, much higher.

Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law.

狗仔卡

狗仔卡 发表于 2015-6-8 08:50 AM

发表于 2015-6-8 08:50 AM

提升卡

提升卡 置顶卡

置顶卡 沉默卡

沉默卡 喧嚣卡

喧嚣卡 变色卡

变色卡