Summary

- CF Industries continues buying stock at a fast clip pushing outstanding shares to an all-time low.

- The nitrogen fertilizer stock currently has one of the highest net payout yields in the market at 15.7%.

- Despite recent highs, investors can own the stock with a keen eye on whether the company maintains a high level of buybacks.

Should investors continue owning CF Industries after it has soared from below $170 about two years ago to over $300 recently?With the mining and commodity sectors mainly in the tank over the last few years due to weakness in Europe and a slowdown in China, CF Industries (NYSE:CF) stands out as a market leader. Not only does the fertilizer stock stand at multi-year highs, but also the company continues buying stock at near insane levels.

Riding The Cash Flow Train

CF apparently missed Q4 '14 earnings estimates by $0.21, but it is mostly irrelevant to this analysis. More importantly, the company produced adjusted EBITDA of $501.3 million during Q4 and over $2.7 billion for the year. While the full-year EBITDA was flat over all, the EPS jumped to $27.08 in 2014 from $24.74 in 2013. While the 2014 numbers did benefit from the sale of the phosphate business, a key takeaway for the per share increase was the sharp decline in outstanding shares to 49.5 million, or a 13.3% reduction from 57.1 million shares last Q4.

The company ended the year with $2.1 billion in cash after purchasing 1.4 million shares for $373 million during Q4. For 2014, CF repurchased $1.9 billion worth of shares, and the market cap sits at only $14.0 billion. The nitrogen fertilizer manufacturer bought another $127 million worth of shares after the end of year until the earnings report on February 17. While the buyback pace clearly slowed down during Q4, the company is still spending enormous amount of cash each quarter.

Amazingly, CF reduced the January share count to the lowest on record at 47.9 million. On top of that, the company has another $500 million approved for more buybacks.

Consistently High Yields

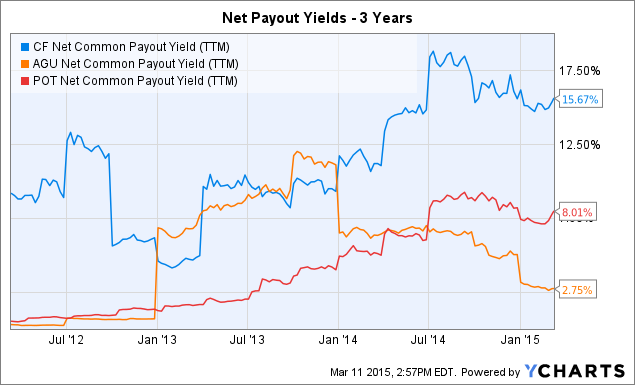

The current high net payout yields (dividend yield, plus net stock buyback yield) of CF have had incredible longevity. In fact, CF has increasingly paid higher yields over the last three years while fellow fertilizer stocks like Potash (NYSE:POT) and Agrium (NYSE:AGU) reduced payouts.

CF Net Common Payout Yield (TTM) data by YCharts

The above yield benefits mostly from a highly volatile stock buyback mentioned above that amounted to a 13.7% yield by itself. The dividend yield only sits at a meager 2.0% though the company did increase it 50% during Q3 '14.

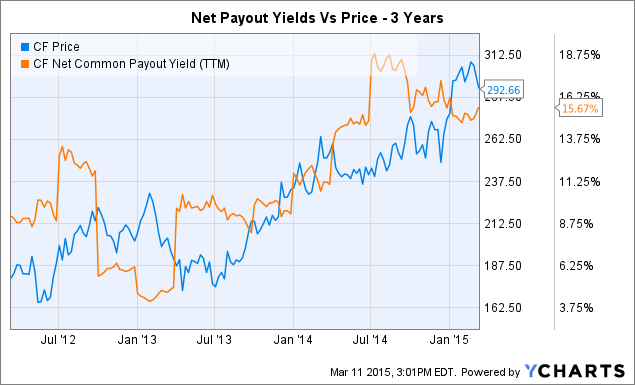

If anything, the high yields suggest that CF remains exceptionally cheap despite the large stock gains over the last couple of years. Typically, the stock price and yields have an inverse relationship. A large stock gain usually pressures yields lower as the company can't generate enough cash flow to keep up with the higher stock price.

CF data by YCharts

Ignoring the stock gains, the high net payout yields recommend owning the stock and riding it even higher. A 15.7% yield actually sits only behindMotorola Solutions (NYSE:MSI) on the top 10 list of the highest net payout yield stocks. The top 10 list contains links to research showing how these top net payout yield stocks outperform the market over the long haul.

Takeaway

CF Industries is a rare stock where strong stock gains haven't kept a lid on the capital return levels of the company. The net payout yields concept primarily identifies stocks trading at 52-week lows with strong cash flows that the market has overlooked. Regardless, the high yields suggest buying the stock. Though, investors need to keep a strong eye on the buyback level. If the company greatly reduces the buyback levels, the 2% dividend won't support owning the stock at these levels.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

狗仔卡

狗仔卡 发表于 2015-3-14 07:46 AM

发表于 2015-3-14 07:46 AM

提升卡

提升卡 置顶卡

置顶卡 沉默卡

沉默卡 喧嚣卡

喧嚣卡 变色卡

变色卡