Introduction

In our earlier article about Q1FY13 silver industry costs, we discussed how much it costs to mine an ounce of silver. This metric can help an investor figure out whether it is time to buy SLV and/or the silver miners. In that analysis, we used the Q1FY13 financials to calculate the combined results of publicly traded silver companies and come up with a true all-in industry average cost of production to mine each ounce of silver.

In this analysis we will calculate the real costs of production of Fresnillo PLC (FNLPF.PK). Fresnillo is the largest primary silver miner in the world (producing about 7% of total annual silver mine supply) and operates the Fresnillo mine in Mexico, which is the largest silver mine in the world. Our goal in this analysis is not to analyze Fresnillo, but it is to calculate their true all-in costs to understand how much it costs to mine each ounce of silver. This will help investors of the silver ETFs (SLV, CEF, and PSLV) understand the true production costs of their asset and show where unsustainable levels of production may lie.

Calculating the True Mining Cost of Silver - Our Methodology

In the previously mentioned article, we gave a thorough overview of the current way mining companies report their costs of production and why it is inaccurate and significantly underestimates total costs. Then we presented a more accurate methodology for investors to use to calculate the true costs of mining gold or silver. Please refer to that article for the details explaining this methodology, which is an important concept for all precious metals investors to understand.

Explanation of Our Metrics

Cost Per Silver-Equivalent Ounce - is the costs incurred for every payable silver-equivalent ounce. It is Revenues minus Net Income, which will give an investor total costs. We use payable silver and not produced silver, because payable silver is the silver that the miner actually keeps and is more reflective of their production. Miners also use payable silver and not produced silver when calculating their cash costs, so this is pretty standard.

We then add Derivative Gains (or minus Derivative Losses), which will give investors total costs without the effects of derivatives. Finally, we add Foreign Exchange Gains (or minus Foreign Exchange Losses) to remove the effects of foreign exchange on the company's costs.

Cost Per Silver-Equivalent Ounce Excluding Write-downs - is the above-mentioned "Cost per silver-equivalent ounce" minus Property/Investment Write-downs and Asset Sales. This provides investors with a metric that removes exceptional gains or losses due to write-downs and asset sales.

Cost Per Silver-Equivalent Ounce Excluding Write-downs and Adding Smelting and Refining Costs - is the above-mentioned "Cost per silver-equivalent ounce excluding write-downs" adding in smelting, refining and all other necessary pre-revenue costs. This is a new metric that we are now introducing to our true all-in cost series because it will more accurately measure all-in costs and allow comparisons between miners.

Most investors are unaware that many miners will remove smelting, refining, and other costs before reporting their total revenues figures and these pre-revenue costs are not reported in the income statement. The result of this is that it skews all-in costs higher for miners that refine themselves or include the costs in their income statement, while inaccurately showing lower costs for miners that remove it before reporting revenues.

A simple test can be done on any miner to see if there are any pre-revenue costs that are not reported in the income statement. Simply take payable production and multiply it by average realized sales price and this should come relatively close to the total revenues figure. If it gives you a number much higher than reported revenues then there are pre-revenue costs that are not being reported.

This line should alleviate these issues and allow comparisons on a fair basis.

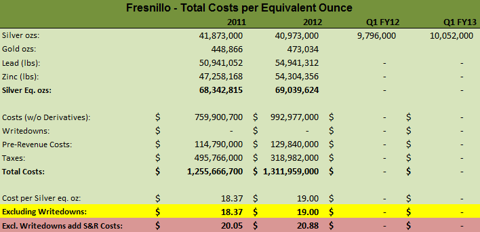

Real Costs of Production for Fresnillo - FY2012

Let us now use this methodology to take a look at Fresnillo's results and come up with their average cost figures. When applying the methodology for the most recent quarter and FY2012, we standardized the equivalent ounce conversion to use the average LBMA price for Q4FY12. This gives us a gold ratio of 53:1, zinc ratio of 37:1, and a lead ratio of 33:1. We like to be precise, but minor changes in these ratios have little impact on the total average price - investors can use whatever ratios they feel most appropriately represent the by-product conversion.

As we stated earlier, the reason to analyze Fresnillo is because they are the largest silver miner in the world and that will give us a very nice benchmark for the true all-in cost to mine silver. From the previous article, we know that many silver miners are producing silver with all-in costs around the low to mid twenties.

Notes about True All-in Costs Table

Fresnillo does not have financial results reported for Q1FY13 (they report on a different schedule than most U.S. companies), so we do not have their all-in costs for the quarter, but we have included their silver production statistics because it is relevant to this discussion.

Observations for Silver Investors

Based on 2012 numbers, it looks like Fresnillo produces silver with true all-in costs of around $20.88, which is up about 4% from their 2011 numbers. This ranks it as a very low cost producer compared to many other silver miners, but at current silver prices their margin is almost nothing.

What is really interesting is that this 4% rise in costs occurred even though taxes dropped by more than $175 million, or around $2.50 per silver ounce. So the drop in taxes actually masked a much greater rise in all-in costs for Fresnillo.

Rising costs at the very largest silver producer show that it is the whole industry that is finding it more expensive to mine silver. That means that it is not a handful of companies or particular geographic locations that are getting expensive - silver is getting more expensive to mine no matter who is mining it.

Production Numbers - As we take a look at Fresnillo's production numbers we find that even though costs are rising it doesn't seem that Fresnillo is producing more silver. In fact their silver production dropped by 900,000 ounces from FY2011 to FY2012. Based on projected first quarter numbers of 10.05 million ounces of silver, it looks like FY2013 may be even less than FY2012.

As investors can see based on their flagship Fresnillo mine (the largest primary silver mine in the world), grades have been dropping fast over the last six years and the company expects them to drop further. This is endemic of the entire industry's problem - costs are rising as ore grades drop. It is not management inefficiencies that is causing costs in the mining industry to rise, but it is clearly because it is getting harder to find quality deposits. That means that rising costs are a structural problem and not a cyclical one.

What is scary for silver miners (and bullish for silver investors) is that the large silver mines are being exhausted and are not being replaced by similarly large mines. This means that unless there is some major industry change (much like what shale did for the oil industry), future silver production will start to drop as production mines are exhausted and new supply will not fulfill the lost production - and this drop may be quite precipitous.

Conclusions for Investors

The largest silver miner in the world is experiencing the same problems as the rest of the silver industry. Costs have been consistently rising even as lower grade ores cause production to drop. Margins also have been significantly hurt, and even low-cost Fresnillo is seeing margins of less than $1 per ounce at current prices and costs continue to rise.

We believe this situation is unsustainable at current silver prices and since much of the cost rises are structural and not cyclical, management at many silver miners will not be able to do much to cut costs. Of course they will cut development costs and overhead, but as ore grades continue to drop this will not be enough to drive down all-in costs and will end up exacerbating the problem by cutting future production of silver.

Silver investors should be patient and realize what we are witnessing is the paper markets dropping the silver price to a level that is lower than miners can extract the metal. This is creating a situation where the longer the silver price stays at or below current levels, the more long-term damage will be done to the industry and the less future supply of silver will be available.

Even though the silver price may drop further in the short term, investors should be comfortable taking a longer time horizon. Accumulate physical silver and the silver ETFs (SLV, PSLV, and CEF) and if investors can be patient enough to hold them for a few years, they should see significant returns as the industry cuts back current and future supply. We do not think that silver production is sustainable anywhere close to current production levels with a silver price under $20 per ounce - short-term traders may take the price below that, but that would make most silver mining unprofitable.

Be patient silver investors because the structural limits of the geology and industry will boost silver regardless of what the Federal Reserve does.

狗仔卡

狗仔卡 发表于 2013-6-19 06:55 AM

发表于 2013-6-19 06:55 AM

提升卡

提升卡 置顶卡

置顶卡 沉默卡

沉默卡 喧嚣卡

喧嚣卡 变色卡

变色卡